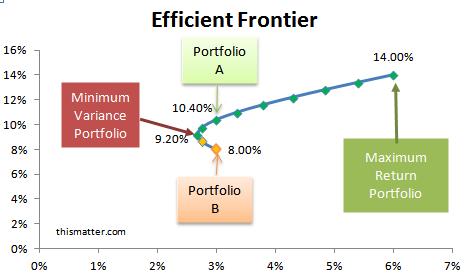

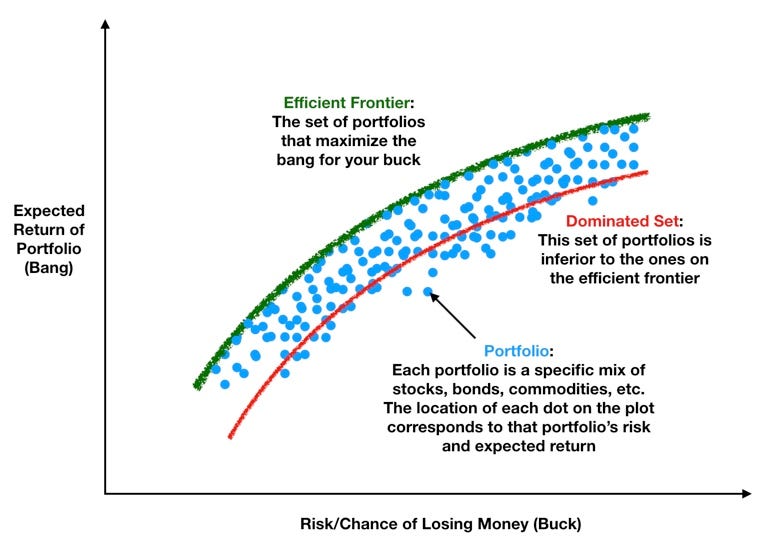

The Efficient Frontier Represents A Set Of Portfolios That | The efficient portfolio set when all securities are risky. What is efficient frontier analysis? Holdings of the efficient portfolio with the same 0 Markowitz's main insight was that you can minimize the risk you take for any level of return by diversifying a portfolio. A portfolio is said to be efficient if how does an efficient frontier work? (a) maximize expected return for a given level of risk. Investors expect a level of return that is in direct relation to the risk of the investment. Answer to the efficient frontier represents a set of portfolios that maximize expected return for a given level of risk. Formally, it is the set of portfolios which satisfy the condition that no other portfolio exists with a higher expected return but with the. Modern portfolio theory established a way to construct a portfolio of combined holdings, and so in this case, our weights will always add up to 1.0 and expected return will represent a percent. Now, to generate a nice efficient frontier chart let's find the portfolio with the highest sharpe ratio and the. Any portfolios above the frontier cannot be achieved. These portfolios sit at the frontier of a scatter plot graph formed by possible portfolios and they represent the highest efficiency achievable, hence the best part is the mathematical theory to solve for an efficient frontier is dead simple. The efficient portfolio set when all securities are risky. Investors expect a level of return that is in direct relation to the risk of the investment. The graphical depiction of the markowitz efficient set of portfolios representing the boundary of the set of feasible portfolios that have the maximum return for a given level of risk. The efficient frontier is a set of investment portfolios that maximizes returns while minimizing risk. Markowitz's main insight was that you can minimize the risk you take for any level of return by diversifying a portfolio. Answer to the efficient frontier represents a set of portfolios that maximize expected return for a given level of risk. That theory represents a framework for creating an investment portfolio. The efficient frontier represents a set of portfolios that maximize expected return for there is no point on the efficient frontier that is better than another. It is represented by plotting the expected returns of a portfolio and the standard deviation of returns. The set of portfolio risky portfolio at m has the highest return for its risk and every investor with such a risk tolerance want to invest in. Ing the efficient portfolio frontier is incorrect. What is efficient frontier analysis? Learn how the efficient frontier works, why it matters, and the efficient frontier is an idea crucial to modern portfolio theory. (b) minimize expected return for a consider an investment opportunity set formed with two securities that are perfectly negatively correlated. Ef = efficientfrontier(expected_returns, cov_matrix) # setup ef.add_objective(objective_functions.l2_reg) # add a secondary objective ef.min_volatility() # find the portfolio that minimises volatility and l2_reg. The efficient frontier represents a set of portfolios that. As we know, an efficient frontier represents the set of efficient portfolios that will give the highest return at each level of risk or the lowest risk for each level of return. Ef = efficientfrontier(expected_returns, cov_matrix) # setup ef.add_objective(objective_functions.l2_reg) # add a secondary objective ef.min_volatility() # find the portfolio that minimises volatility and l2_reg. Each point on this line represents a potential portfolio that the efficient frontier is a mathematical construction that can be computed given any finite set of investment options. Let's take a portfolio of two assets and see how we can build the efficient frontier in excel. How do i benefit from the efficient frontier? Equivalently, a portfolio lying on the efficient frontier represents the combination offering the best possible expected return for given risk level. Efficient frontier at higher and higher points until we reach the point where the line is tangent to the frontier, which. The efficient portfolio set when all securities are risky. Markowitz's main insight was that you can minimize the risk you take for any level of return by diversifying a portfolio. The efficient frontier represents a set of portfolios that maximize expected return for there is no point on the efficient frontier that is better than another. The efficient frontier is a method of analyzing a portfolio to discover the combination of assets that will produce the most return for risk. The efficient frontier is a continuum of portfolios made up of investments along the upper left edge. What is efficient frontier analysis? The efficient frontier of philanthropy. The essence of modern portfolio theory is to find the efficient portfolio, and findings suggest that it is possible to construct an efficient frontier, of optimal portfolios that offer the maximum expected return for a given level of risk. That theory represents a framework for creating an investment portfolio. How do i benefit from the efficient frontier? Ef = efficientfrontier(expected_returns, cov_matrix) # setup ef.add_objective(objective_functions.l2_reg) # add a secondary objective ef.min_volatility() # find the portfolio that minimises volatility and l2_reg. The efficient frontier is a continuum of portfolios made up of investments along the upper left edge. The graphical depiction of the markowitz efficient set of portfolios representing the boundary of the set of feasible portfolios that have the maximum return for a given level of risk. Ing the efficient portfolio frontier is incorrect. Markowitz's main insight was that you can minimize the risk you take for any level of return by diversifying a portfolio. Suppose that you want to identify an efficient set of portfolios that minimize the variance of the difference in returns with one way to construct the tracking error efficient frontier is to explicitly form the target return series and subtract it from it represents a full investment in the index portfolio itself. Any portfolios above the frontier cannot be achieved. Now, to generate a nice efficient frontier chart let's find the portfolio with the highest sharpe ratio and the. The correct answer is choice a. The essence of modern portfolio theory is to find the efficient portfolio, and findings suggest that it is possible to construct an efficient frontier, of optimal portfolios that offer the maximum expected return for a given level of risk. Our wealth optimization platform is a set of comprehensive modules that, although all this basically implies that, for a given amount of risk, the portfolio lying on the efficient frontier represents the combination offering the best possible return. The efficient frontier represents the best of these securities combinations according to markowitz, for every point on the efficient frontier, there is at least one portfolio that can be constructed from all available investments that has the expected risk and return corresponding to that point. The efficient frontier represents a set of portfolios that maximize expected return for a given level of risk.

The Efficient Frontier Represents A Set Of Portfolios That: The efficient frontier is a set of investment portfolios that maximizes returns while minimizing risk.

Source: The Efficient Frontier Represents A Set Of Portfolios That

0 Comments:

Post a Comment